COVID-19 has hit the automotive industry hard, but if the industry is one thing, it is resilient.

Mike Wall, executive director, automotive analysis with IHS Markit presented an industry outlook during the virtual Auto Care Leadership Days, show the contraction seen during the pandemic and also the growth expected going forward.

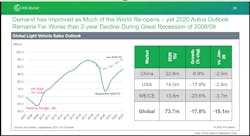

The recession in the industry is likely deeper than than seen during the global financial crisis of 2008-2009, Wall said. The industry was down 5 percent in 2008 and 3 percent in 2009, and currently the growth in 2020 sits at nearly negative 18 percent (Figure 1). “The difference is how deep the contraction is right now, but the market is expected to surpass 2018 and 2019 levels by 2021 and continue growing into 2022,” he said.

First-time buyers are helping push automotive sales globally, with many driven to buy vehicles as a way to reduce use of public transportation, and because of upcoming planned travel, Wall said, referencing the results of IHS’s recent “Vehicle Buyer’s Journey” survey.

“Consumers are coming into the market, and in some cases, for the first time,” Wall said. “I think we are making the best of things.”

Wall also gave an overview of the vehicles on the road today (Figure 2). “The pool of potential buyers remains strong,” he explained, showing that 43 percent of vehicles on the road are model year 2008 or older. “So the repair factor is going to remain resilient,” Wall said.

The recovery of light vehicle sales is expected to be quick, but there is concern that a second wave of COVID-19 could derail the market (Figure 3), Wall said. He presented three forecasts:

· Baseline — Efforts to contain COVID-19 shutter large swaths of the economy and create deeper recession than 2008-2009. Inventory in the system offsets some of the plant disruption impact, yet also limits near-term growth prospects. OEMs prioritize production of more profitable programs (e.g. trucks).

· Optimistic — The forecast reflects a broader V-shaped recovery as stimulus measures are expanded globally. Additionally, data from HIS Markit’s “Vehicle Buyers Journey” survey points to COVID-19 boosting interest (bio-safety) and increasing demand for private car ownership in the U.S., Western Europe and China. A stronger economic response in 2021-2023 accelerates recovery in light vehicle demand.

· Pessimistic — High COVID-19 infection rates in parts of the world create the risk of a W-shaped cycle with a second downturn in the global economy in late 2020. Additionally, stimulus measure prove ineffective at backstopping the crisis and unemployment rates remain elevated. Economic recovery begins later and at a much slower rate. Severe contractions last through the first quarter of 2021 and consumer confidence remains depressed.

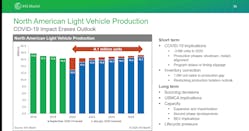

On the vehicle production side, North American is down 3.6 million units in 2020 from where it was anticipated, Wall said. Looking out to the future, the industry will be making gains in production, but from 2020 through 2027, will still produce 9.1 million fewer units than anticipated going into 2020 (Figure 3).

The pandemic has also created delays in launching new vehicle models, Wall said. Launches in late 2021, 2022 and 2023 could be subject to further delay, reprioritization, rescoping or even cancellation. If possible, OEMs will review portfolios to extend current vehicles — possibly integrating new minor moderate facelifts to extend the lifecycles.

There will be extensive growth going forward in battery electric vehicles (BEVs), with more than 35 all new nameplates. “Automakers are still moving along on an electrified path. When we get to 2022 and beyond, we are expecting much more EV adoption,” Wall said. “More vehicles are coming down the pike. And not just for new upstarts; it includes GM, Ford and many others.”

One other impact from COVID-19 has been a change in vehicle ownership trends. Going into 2020, ride sharing and lower vehicle ownership rates were on the rise. But currently, “personal ownership of vehicles is looking good. That’s not to say Uber or Lyft are going away. They are not moving a lot of people right now, but they are moving a lot of product. But the vehicle ownership structure may change and shift, and it will be an interesting dynamic,” Wall said.