In a look back on what was deemed “a fascinating year,” market research firm NPD Group gave insight on retail trends and miles driven in the industry and what we can expect going forward.

Nathan Shipley, executive director of industry analysis, automotive, presented “Retail & Aftermarket Trends” as part of this year’s virtual AAPEX experience. While he deemed it challenging in a normal year to forecast out 12 months, this year has left many uncertainties in predicting the market next year as a host of elements are out of our control — including weather, working at home and even back to school schedules. But he delved into the retail environment and some of the trends they’ve seen.

The retail environment

Shipley outlined five phases consumers and retailers will move through during the public health crisis (Figure 1):

1. Realization – Awareness and initial reaction to crisis

2. Reality – Stores open, yet vehicles sit idle throughout the country. Miles driven declines significantly.

3. Restart – Foot traffic increases, consumers consider non-discretionary purchases

4. Recovery – Categories begin to see signs of growth, miles driven begins to improve

5. Re-emerge – Back to business as usual in some industries

"We are currently in the reality phase of weak demand and an idle car park,” Shipley said.

While the holidays approaching tend to translate to a sales spike for many industries, the aftermarket never been a seasonal industry in terms of shopping. But there is an opportunity to boost sales because so many people have picked up new hobbies in the garage over the past 6 months, Shipley said.

Things overall are trending generally positive for automotive aftermarket retail — but based on location. Things are down more on the coasts in light of weather (wildfires and hurricanes, primarily) and more stable in the Midwest.

Retailers with strong platforms are finding growth through ecommerce, notably as consumers have focused on DIY projects at home and in the garage. Shipley estimated the shift to ecommerce has accelerated 3-5 years due to COVID and its impact on online sales.

Discretionary spending preferences

A number of industries have seen an impressive amount of demand in light of remote learning, working at home, DIY projects, cooking at home and more, pushing retail demand higher in July 2020 compared to July 2019 levels.

Specific to automotive, the battery category has grown $164 million year over year from August 2019 to 2020.

But other industries were hit hard. Apparel sales are down 20 percent and declined $6.5 billion in June and July alone, while areas like new home offices, home schooling needs, new pets and DIY projects took precedent.

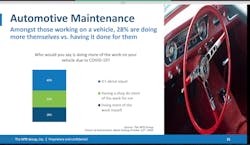

DIY automotive maintenance is also on the rise, with 40 percent of respondents reporting no change in their maintenance habits, but 28 percent saying they are doing it themselves — 13 percent of which are doing projects or work they’ve never done before (Figure 2).

Miles driven

Miles driven is down 15.3 percent year to date through August 2020, while gasoline supplied has mirrored this, declining more than 13 percent so far in 2020 compared to 2019.

But there are opportunities for miles driven to increase. Many are concerned about mass transit, especially air travel, leading into the holidays. So, this may impact the amount of people who drive instead.

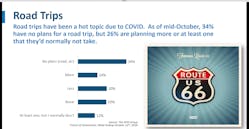

“There are multiple stories within the overall miles driven number; some positive, some negative. For some, the 7 a.m. commute is dead for a lot of people; likely permanently. Yet gas prices are low and road trips are hot,” Shipley said.

As of mid-October, 26 percent are planning more or at least one road trip that they’d normally not take (Figure 3).

Driving patterns and therefore miles driven are expected to have been permanently impacted by COVID, but long-term behavior will ultimately determine future trends, Shipley said. This means general behavior will shift to reflect more permanent emerging lifestyles, such as new working patterns, school considerations or entertainment habits. And as unemployment continues to drop, there is the expectation of miles driven continuing to rise.

Retail aftermarket performance

The retail, front-room aftermarket (Advance Auto Parts, O’Reilly’s, Pep Boys and Walmart, Shipley said) has experienced overall impressive growth in 2020. The industry grew 4.4 percent in dollar volume during the most recent week. Year to date, aftermarket retail is up 6.9 percent.

A big chunk of consumers spent stimulus monies on discretionary items. And 28 percent of recent aftermarket purchases were influenced by COVID — 13 percent said they had no intentions of making purchases but did, while the remaining 15 percent planned purchases later in the year but bought them early.